Schemes and Benefits Eligibility Test

Schemes and Benefits Eligibility Test

Decision Making is the process in which an outcome is derived by evaluating and analyzing the given information. The objective of Decision making is to reach a specific conclusion from the given data or a given set of conditions

Introduction : In this type of questions, you are given the necessary qualifications required to be fulfilled by a candidate for a certain vacancy in job/promotion/facility, along with the bio-data of certain candidates who have applied for the same. You are then required to assess the candidate's eligibility or potential and thereby decide upon the course of action to be taken from among the given alternatives.

Direction : - Study the following information carefully and answer the questions given below :

Following are the conditions for granting advance of Rs. 10 lakhs to the farmers for purchasing tractor, by a Gramin Bank. The farmer must -

In the case of a farmer who satisfies all other criteria except

Mark answer

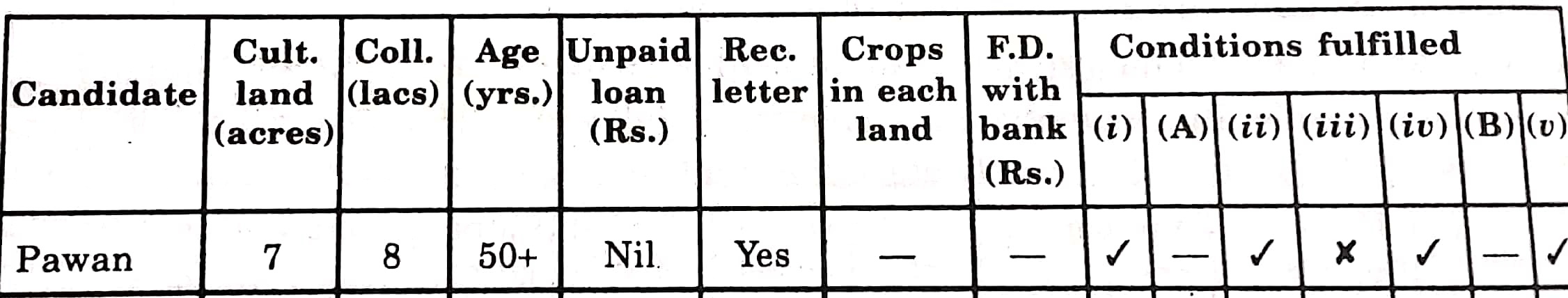

Question : Pawan Mohanty has obtained a recommendation letter from the Panchayat Pradhan. He has seven acres of cultivable land and can produce collateral of Rs. 8 lakhs. He was born on 4th July, 1955. He doesn't have any outstanding loan from the bank.

We shall mark the conditions fulfilled by "Right" those not fulfilled by "Wrong" and those about which information is not available by '?'.

Solution : (a)

Read the following information carefully and answer the question given below it: A company has following Gratuity (G) and provident Fund (PF) rules : (1) An employee must have completed one year's service to be eligible for either G or PF. (2) An employee resigning or retiring or retrenched after ten years' service gets both G and PF. (3) An employee retrenched or retiring after 5 years but before 10 years' service gets both G and PF, but that resigning during this period gets either G or PF. (4) An employee retrenched or retiring before 5 years' service gets PF but not G; but that resigning during this period gets neither G nor PF. However, (5) in case an employee dies after 2 years' service, his family gets both G and PF. (6) in case an employee was on leave without pay, such period is deducted from his total years of service and then the above rules are applied. (7) in the case of a lady employee, if she has completed 2 years' service, two years are added to her actual service before applying the above rules, as a special consideration. Apply the above rules to the cases described in each of the following questions and decide weather the employee is eligible for G and /or PF. Mrs. Sharma served the company for four years and resigned. | |||

| Right Option : C | |||

| View Explanation | |||

Read the following information carefully and answer the question given below it: A company has following Gratuity (G) and provident Fund (PF) rules : (1) An employee must have completed one year's service to be eligible for either G or PF. (2) An employee resigning or retiring or retrenched after ten years' service gets both G and PF. (3) An employee retrenched or retiring after 5 years but before 10 years' service gets both G and PF, but that resigning during this period gets either G or PF. (4) An employee retrenched or retiring before 5 years' service gets PF but not G; but that resigning during this period gets neither G nor PF. However, (5) in case an employee dies after 2 years' service, his family gets both G and PF. (6) in case an employee was on leave without pay, such period is deducted from his total years of service and then the above rules are applied. (7) in the case of a lady employee, if she has completed 2 years' service, two years are added to her actual service before applying the above rules, as a special consideration. Apply the above rules to the cases described in each of the following questions and decide weather the employee is eligible for G and /or PF. Mr. Gaur served in the company for five years and resigned from the company. | |||

| Right Option : C | |||

| View Explanation | |||

Read the following information carefully and answer the question given below it: A company has following Gratuity (G) and provident Fund (PF) rules : (1) An employee must have completed one year's service to be eligible for either G or PF. (2) An employee resigning or retiring or retrenched after ten years' service gets both G and PF. (3) An employee retrenched or retiring after 5 years but before 10 years' service gets both G and PF, but that resigning during this period gets either G or PF. (4) An employee retrenched or retiring before 5 years' service gets PF but not G; but that resigning during this period gets neither G nor PF. However, (5) in case an employee dies after 2 years' service, his family gets both G and PF. (6) in case an employee was on leave without pay, such period is deducted from his total years of service and then the above rules are applied. (7) in the case of a lady employee, if she has completed 2 years' service, two years are added to her actual service before applying the above rules, as a special consideration. Apply the above rules to the cases described in each of the following questions and decide weather the employee is eligible for G and /or PF. Mrs. Rashmi served in the company for years and was retrenched. | |||

| Right Option : D | |||

| View Explanation | |||

Students / Parents Reviews [10]

My experience with Abhyas is very good. I have learnt many things here like vedic maths and reasoning also. Teachers here first take our doubts and then there are assignments to verify our weak points.

Shivam Rana

7thIt has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thA marvelous experience with Abhyas. I am glad to share that my ward has achieved more than enough at the Ambala ABHYAS centre. Years have passed on and more and more he has gained. May the centre flourish and develop day by day by the grace of God.

Archit Segal

7thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thAbhyas is a complete education Institute. Here extreme care is taken by teacher with the help of regular exam. Extra classes also conducted by the institute, if the student is weak.

Om Umang

10thMy experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thIt was good as the experience because as we had come here we had been improved in a such envirnment created here.Extra is taught which is beneficial for future.

Eshan Arora

8thAbhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.